New LPPL signals on UK rates supports Sonia vs Euribor trade

- New LPPL Climax signals on UK 2y gilt adds conviction to our original BoE vs ECB policy convergence trade from 31 May (link).

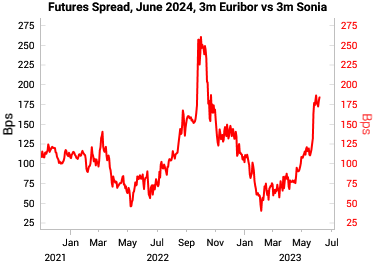

We first flagged the Bank of England (BoE) vs ECB policy convergence trade on 31 May (link). Buy June 2024 Sonia Futures (SFIM4) vs Selling June 2024 Euribor Futures (ERM4).

We now have added conviction on this trade as LPPL climax signals have trigged on 2y gilt (UK) futures outright (chart below), indicating the crash is ending and is likely into the bottoming process. For more on LPPL intuition see here.

LPPL climax signals are rare historically and worked well previously on 2y gilt futures (left chart below). When a LPPL climax occurs concurrently with a VP Reversal Signal (inspired by Demark, right chart below), that is usually a very strong signal.

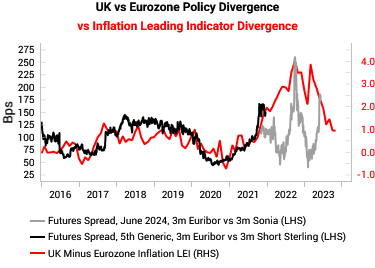

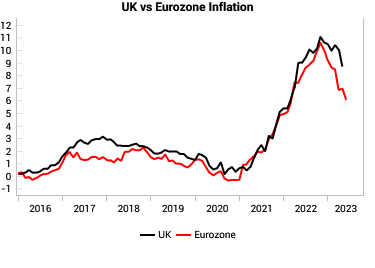

The spread has not moved much since we first flagged the trade (left chart below). In the post-Brexit period, UK and Eurozone inflation has been highly correlated, and it is rare to see large divergences between the pricing of BoE and the ECB. Spreads were only wider during the Liz Truss mini-budget debacle from 2022.

|  |

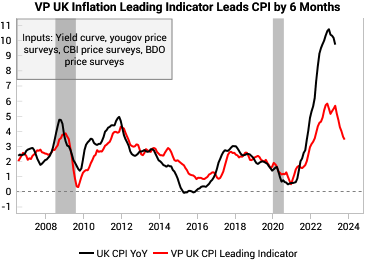

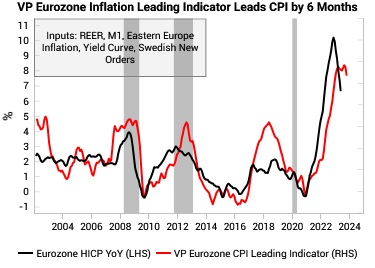

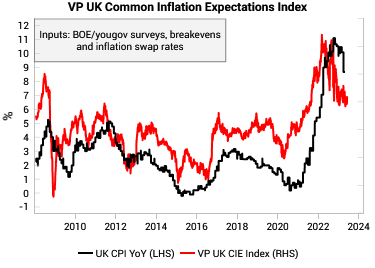

Below we also show again the key UK vs Eurozone inflation charts. At present our UK inflation LEI is showing a strong roll-over vs the ECB, although the broad direction of travel is that both UK and Eurozone inflation is set to roll over. Our measure of inflation expectations, VP's common inflation expectations (CIE) index shows both the UK and the Eurozone rolling over in unison.

|  |

|  |

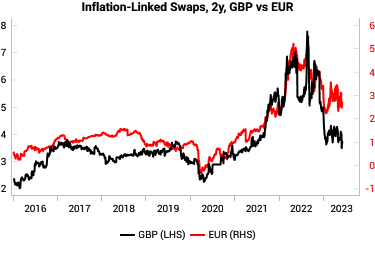

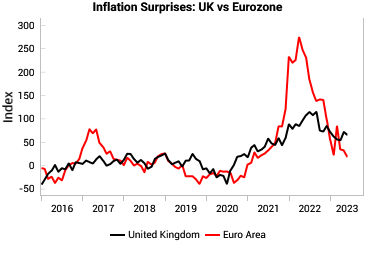

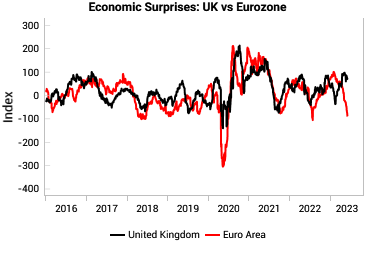

Realized inflation has been highly correlated in the post-Brexit period (top left chart below) and inflation swaps broadly trade together (top right chart below). We also show inflation and economic surprises below. Economic surprises (bottom right chart below) is the main indicator supporting the divergence of policies, but surprises are typically mean-reverting, so we are keeping an eye on how these series evolve.

|  |

|  |