MBS ETFs: Why now & how

- We have received a flurry of questions about ETF implementation in response to our previous write-ups on MBS (link) and duration risk (link).

- Owning agency MBS offers similar exposure to owning a 10y US Treasury while selling a call option (covered call). Agency MBS securities have no credit risk and today pays investors handsomely for taking on “negative convexity” risk.

- Popular MBS ETFs (eg MBB, VMBS) are NOT good options for monetizing the “expensive” call option mentioned. MTBA is a new ETF launching this week and focuses on newly issued MBS, which avoids this problem.

- We have NO financial affiliation with Simplify or Harley Bassman. Our only incentive to flag financial products is because we think they solve a problem for our clients.

Understanding mortgage-backed security (MBS) convexity

We have received a flurry of questions about ETF implementation in response to our previous write-ups on MBS (link to Agency MBS: duration with extra margin of safety) and duration risk (link to What's Driving the Bond Term Premium). To recap:

Owning agency MBS offers similar exposure to owning a 10y US Treasury while selling a call option (covered call). Agency MBS securities have no credit risk and today pays investors handsomely for taking on “negative convexity” risk.

The implicit call option is very expensive today given the high level of fixed income volatility. The “negative convexity” results from borrowers prepaying their mortgages early when interest rates fall, causing MBS investors to forgo the high coupons.

The key issue we flagged is that the major MBS ETFs such as MBB (27bn USD AuM) and VMBS (16.9bn USD AuM) are NOT good options for monetizing the “expensive” call option mentioned.

These ETFs track passive market-cap weighted MBS indices, which hold a lot of legacy MBS that were issued when interest rates were much lower (lower interest rates = lower coupons). The mortgages behind these legacy MBS are now held by lucky households who locked in very low mortgage rates and who have minimal incentive to refinance. This means the “call option” one sells when buying these legacy low coupon MBS is almost worthless.

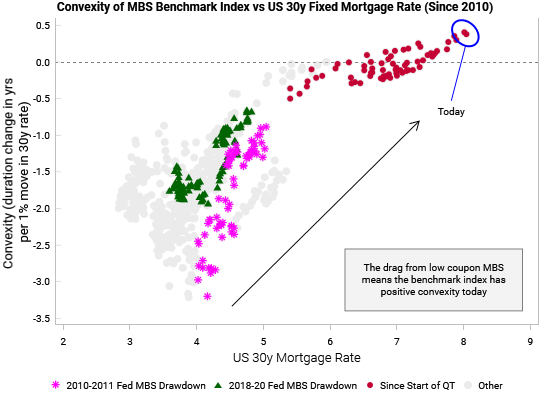

In practice, this means these legacy MBS behave like normal treasuries. One can visualize this in the chart below. A normal US treasury security has “positive convexity” (i.e. the price of the bond goes up more when interest rates fall, and down less when rates rise). MBS normally has “negative convexity” due to the selling of the call option (which overwhelms the positive convexity from the bond exposure). However, as these call options become more out of the money, low coupon MBS can have positive convexity due to the underlying bond exposure.

MTBA: An ETF focused on newly issued MBS

We have NO financial affiliation with Simplify or Harley Bassman. Our only incentive to flag financial products is because we think they solve a problem for our clients.

This week, Simplify is launching an MBS ETF (Ticker: MTBA, link) focused on newly issued MBS that avoids the abovementioned convexity problem. This offers non-specialist investors an easy way to gain exposure to our bullish MBS theme.

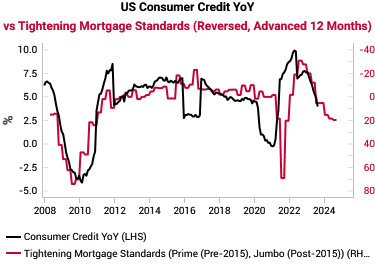

Unsurprisingly, as mortgage rates have surged and lending standards have tightened, mortgage originations have slowed, but this remains a deep market with 100s of billions of originations still forecast each quarter over the next 2 years.

|  |

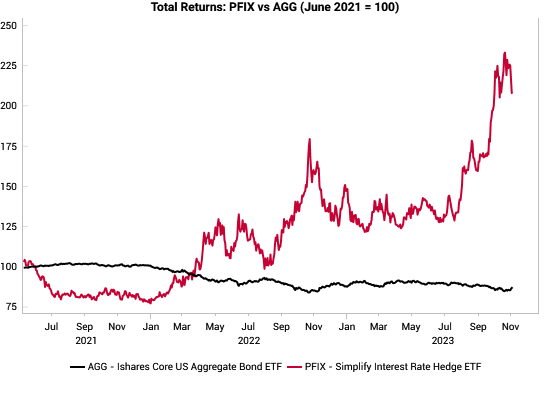

The only previous time we flagged a Simplify product was back in June 2021, when we flagged PFIX as an easy implementation for investors to get exposure to swaptions in anticipation of inflation risks. To quote from June 2021:

Another new ETF that is trying to offer fixed income convexity to equity investors is the PFIX, which holds 5y treasury bonds and 7y20y payer swaptions. This is very similar to our own 10y20y swaption trade… that we initiated in Feb 2021.

This kind of swaption is much more of a long-term hedge for extreme tail moves in US rates… The danger with low AuM ETFs is not actually liquidity of trading as the ETF can be created or redeemed, so the liquidity of the strategy actually depends on the underlying liquidity rather than the fund AuM. However the low AuM is a business risk as low AuM ETFs often get shut down and de-listed if the fund does not get enough traction.

The macro context

We think owning MBS fits our main fixed-income themes well. To quote:

1969-70 remains our roadmap (first addressed in March): Fed will prioritize inflation credibility and only cuts rates on bad growth (i.e. bad labor market). To repeat:

The Fed does not want to repeat the mistakes of 1969-70 or 1979-80 by cutting too early and have to hike again in short order, ruining their inflation credibility in the process.

Back in 1969-70 the Fed held off on rate cuts for as long as possible until they were forced into a “catch-up” cut when the labor market started to break.

Today’s tight labor market remains a feature and not a bug of the high inflation labor hoarding environment. The implication is the Fed only cuts when growth deteriorates sufficiently to cause labor markets to break.

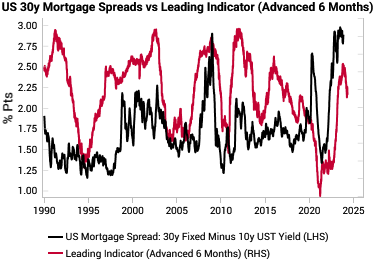

This means the payoff to being long duration in this cycle will be delayed… making MBS the more attractive option today. The valuation / entry point is compelling. The MBS spread to 10y is very wide (left chart below) and much wider than IG spreads. Our leading indicator for mortgage spreads has also rolled over (right chart below).

|  |

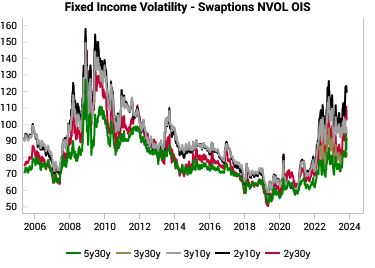

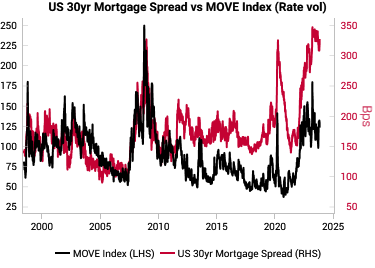

Fixed income volatility remains dislocated and very high. Owning newly issued MBS is effectively shorting longer-dated fixed-income volatility. The left chart below shows some relevant swaptions showing that implied volatility today remains very high. For context, given the popularity of the MOVE index, we also show that in the right chart below. However, we note the MOVE is simply 1m volatility (analogous to the VIX) and is not the actual volatility exposure you are taking on by buying MBS.

|  |