Buy Canadian Bonds: Tactical Aligns, BoC Pause, Growth/Inflation Downside

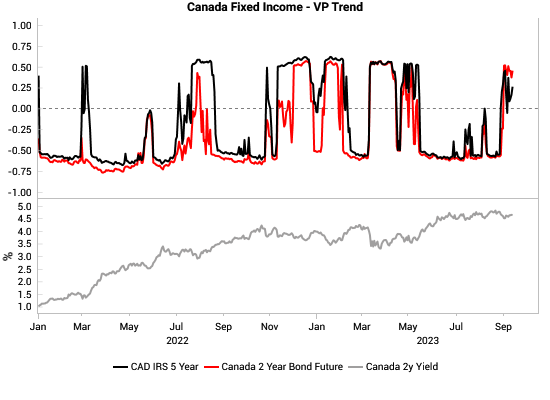

- Tactically (1-3m outlook), both the trend and mean-reversion components in VP's Tactical Outlook framework (link to whitepaper) are now bullish (price higher, yields lower) on Canadian front-end and the belly (5y).

- Cyclically (6-12m outlook), our inflation and growth leading indicators show downside risks. The BoC paused rate hikes this month, waiting to see the lagged impact of previous rate hikes given the recent dip in growth.

Tactical Outlook Bullish on Canadian Bonds (price up, yield down)

Both the trend and mean-reversion components in VP's Tactical Outlook framework are now bullish (price higher, yields lower) on Canadian front-end and the belly (5y). In the context of the Bank of Canada (BoC) pause this month, this creates an attractive entry point to buy Canadian front-end & belly or receive in swap space.

|

We don't assign too much weight to tactical tools unless there is a good macro/cyclical/fundamental context to justify the trade. There is plenty of justification right now for Canadian fixed income.

The bottom panes of the below Tactical Outlook charts on the 2-year bond future and the Canadian 5y Interest Rate Swap (IRS) show trend and mean-reversion components now favor betting on lower yields.

Cyclical indicators flag unambiguous downside risks to growth and inflation

The BoC erred on the side of caution this month by pausing hikes, waiting to see the lagged impact of previous rate hikes given the recent dip in growth (June GDP MoM was negative).

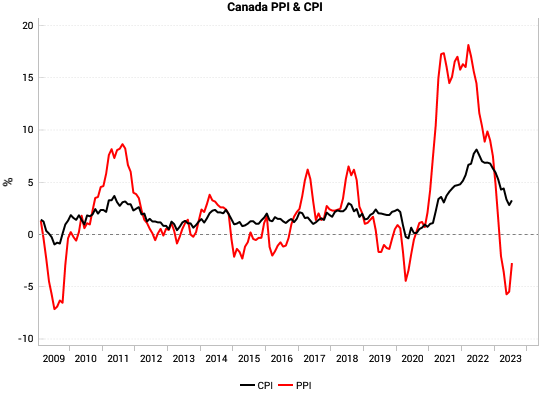

Our Canada inflation leading indicator (top left chart) continues to drop. This is corroborated by CFIB price and wage surveys (top right chart). Input cost pressures are also alleviating, with PPI YoY now negative and surveys of input difficulties rolling over (bottom two charts below).

|

Growth also has downside risks. Our Canada leading indicator has collapsed (weighed down by China-linked inputs, top left chart). The magnitude of the LEI drop is most likely overstated, but the direction is certainly down. Canadian retail sales are holding up, but new durable goods orders are now falling (top right chart).

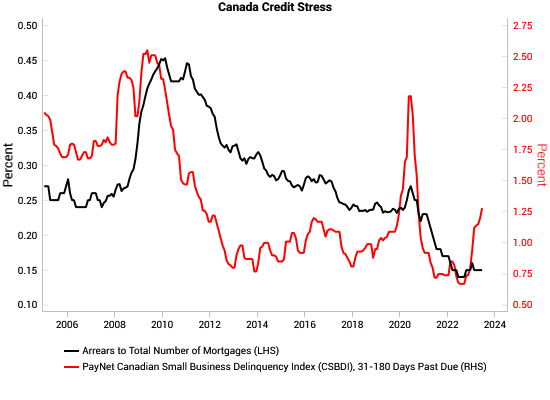

Canadian small business delinquencies are picking up (left chart) showing monetary tightening is starting to gain traction. South Korean exports have historically been a good early warning for global trade conditions and lead Canadian exports by about 6 months (right chart). At present this shows cyclical global headwinds for the Canadian economy.

|

The deep inversion of the Canadian yield curve has historically had a very good lead on inflation and growth. Most yield curve segments are now inverted (bottom left chart). Canadian households also typically cannot fix their mortgages for more than 5 years, so are more vulnerable to higher rates. This will remain a steady headwind as households refinance their mortgages (bottom right chart).

Housing has stabilized at lower levels, with starts, building permits and transaction volumes bottoming, but given the lagged and steady headwind from previous rate hikes, this is unlikely to morph into a big recovery without BoC rate cuts.

The market is pricing one more hike for the BoC. Given the above outlook for growth and inflation, we see little upside risk to pricing in more hikes.

As we laid out in our September LIW report (link), US cyclical disinflationary pressures will become more evident as the shelter CPI distortions have been absorbed. This reduces the risk of the Fed further dragging up the BoC policy rate.

In principle, buying USDCAD would also be a good expression of this theme too and our analog finder (left chart) is showing strong upside. However, Canada's terms of trade have been improving recently (right chart), given the rise in oil prices, so we think it is a less clean expression of the underlying theme.